“If you can help reduce our days sales outstanding (DSO), that will be a big win.”

This is what I heard recently from the Director of Finance for a freight broker. At the time of our conversation, he had a DSO of more than 47 days and as a result was feeling the pressure on his cash flow.

Understanding DSO

DSO, in simple terms, measures the average number of days it takes for a company to collect payment after a sale is made. In the context of a freight brokerage or 3PL, this metric gauges the efficiency of your credit and collection processes. A lower DSO, which is a positive, is an indication that clients are settling their invoices promptly. Doing so provides organizations with a healthy cash flow, working capital and the ability to invest in key expansion areas of the business.

A high DSO of course means the opposite. Clients are slower to pay, cash flow is tight and the ability to make strategic investments in the business is limited.

Why DSO Matters for 3PLs and Freight Brokers

Not all freight brokers and third-party logistics providers measure DSO, but they should. Having insight into this metric and being able to reduce DSO provides tremendous benefit and can be the difference between accelerating growth and plateauing. Here are a few reasons why DSO matters

Cash Flow Optimization

In the logistics industry, where cash flow fluctuations are common due to the timing difference between paying carriers and receiving payments from customers, managing DSO becomes paramount. A streamlined DSO ensures that the company has sufficient cash reserves to meet operational demands, invest in technology enhancements, and seize growth opportunities as they arise.

Working Capital Efficiency

An efficiently managed DSO results in reduced tied-up capital in accounts receivable. This accessible capital can be reinvested to fund new ventures, used to negotiate better terms with carriers, or provide incentives for clients to increase their business with your company.

Risk Mitigation

A prolonged DSO can signal potential credit risks. By monitoring this metric closely, you can identify clients who might be struggling financially, allowing you to take proactive measures to mitigate risks, such as modifying payment terms or implementing credit controls.

Business Agility

Rapidly growing companies require agility to capitalize on opportunities. A lower DSO provides the flexibility to make quick decisions, secure strategic partnerships, and take on new clients without being hampered by liquidity constraints.

Managing DSO and taking steps to reduce it is one of the best ways to improve the financial health of your organization. How you do this can vary, but here are a few steps that organizations can take to ensure a lower DSO.

Automated Invoicing

Invest in technology to automate and expedite your invoicing process. This minimizes errors that are commonly found with human interventions, can quickly identify and resolve invoicing disputes, and will accelerate the payment cycle.

Clear Payment Terms

Communicate clear and concise payment terms to your clients. Transparency enhances the likelihood of prompt payments and reduces misunderstandings.

Effective Collections

Implement proactive collection strategies, including timely follow-ups on overdue invoices. A dedicated collections team can significantly impact DSO.

Client Relationship Management

Build strong relationships with your clients to encourage timely payments. Understand their unique payment processes and work collaboratively to ensure smooth transactions.

Data Analytics

Leverage real-time data analytics to identify trends and potential bottlenecks in your collections process.

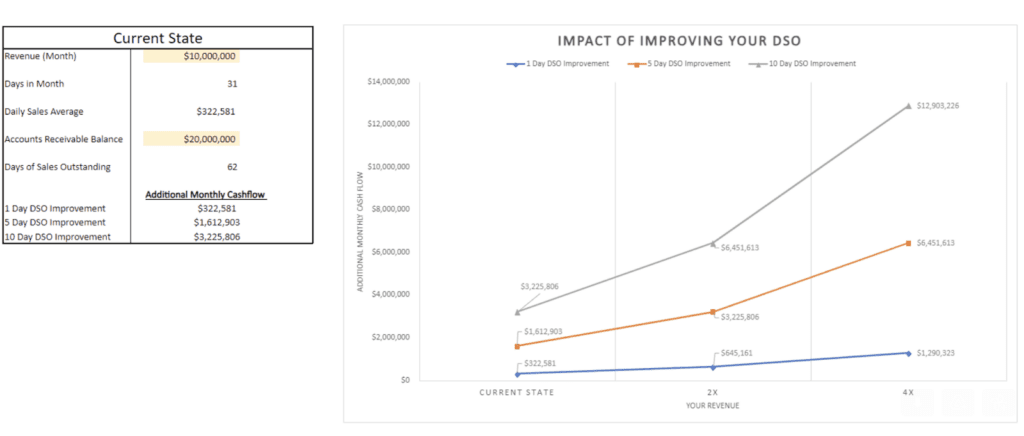

If you are wondering how a reduction in DSO can impact your organization, see the graphic below. This was an assessment we conducted recently for a 3PL that indicates the additional cashflow they would receive by improving DSO by 1, 5 and 10 days. As you can see the results are dramatic and would be a financial boost for the organization.

Effective DSO management transcends its role as a financial metric; it becomes a catalyst for corporate growth and brokers and 3PLs that are looking for ways to grow in a competitive market, should be looking at how to improve their DSO.

If you would like to get a no strings assessment for your organization and see how Navix can help, let us know.